Maple Disruption 2025

On this page

Overview

Maple Disruption 2025 is a cross-sector initiative aimed at disrupting or degrading key enablers that fraudsters and cybercriminals rely on to commit their crimes, including malicious email addresses, phone numbers, bank accounts, cryptocurrency accounts. This operation took place from December 8 to 11, 2025.

For this year’s sprint, the Canadian Anti-Fraud Centre (CAFC) and the RCMP’s National Cybercrime Coordination Centre (NC3) brought together fraud fighters from over 25 partner organizations, including financial institutions, telecommunications services, tech companies, cryptocurrency exchanges, government agencies, non-profit organizations, academic institutions and more.

Nobody can fight fraud and cybercrime alone. By drawing on the expertise of various sectors, law enforcement is better able to understand every angle of the crimes threatening Canadians online, helping us shut them down before they hit home.

Partners

- Alberta Securities Commission

- Autorité des marchés financiers

- BMO Financial Group

- Central 1

- Canadian Imperial Bank of Commerce (CIBC)

- Competition Bureau Canada

- Canada Revenue Agency (CRA)

- Desjardins

- Equifax Canada Co.

- Google, LLC

- Interac

- Meta

- Microsoft

- National Bank of Canada

- NCFTA

- NDAX Canada Inc.

- NetBeacon Institute/Public Interest Registry

- Ontario Securities Commission

- Ottawa Police Service

- RCMP Federal Policing Cybercrime

- RCMP Federal Policing Financial Crime

- Royal Bank of Canada

- Scotiabank

- Sun Life

- Sûreté du Québec

- Toronto-Dominion Bank

- Université de Montréal – Clinique de cyber-criminologie

Results

Maple Disruption partners worked together to identify instances of suspected fraud and coordinated over 3,000 disruptive actions against fraud enablers. These included:

- shutting down malicious email accounts

- blocking malicious phone numbers

- taking phishing websites down

- flagging suspicious transactions

- blocklisting criminal cryptocurrency addresses linked to fraud

Maple Disruption 2025 by the numbers

- Fraud reports

1,622 - Disruptive actions

3,021 - Reported losses

$4,7 M

-

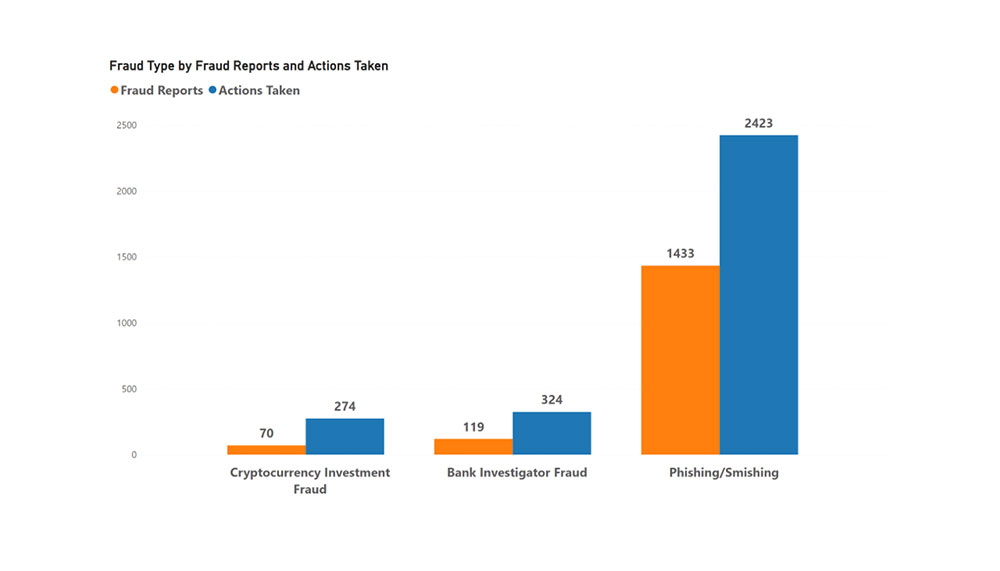

Fraud type by fraud reports and actions taken – Text version

Fraud type by fraud reports and actions taken Fraud type Fraud reports Actions taken Cryptocurrency Investment Fraud 70 274 Bank Investigator Fraud 119 324 Phishing/Smishing 1,433 2,423 Note: Count of the total number of actions taken within the different fraud types tracked during the operational sprint.

| Finance (59%) | Government (17%) | Telecommunications (15%) | Law Enforcement (8%) | Academia (1%) | |

|---|---|---|---|---|---|

| 954 | 273 | 241 | 130 | 24 | |

Note: Count of fraud reports received from participating source providers by sector. |

|||||

Image gallery

Testimonials

National Bank of Canada is a proud partner of Maple Disruption 2025. I saw firsthand the incredible synergies developed when the right cross-industry participants from private and public sectors are brought into the same room. Sharing intelligence in real time is a powerful way that we can truly counter the epidemic of fraud. National Bank, a partner in the Canadian Anti-Scam Coalition, is ready to take the next steps and work with all partners and government to leverage what was learned in Maple Disruption 2025, continuing to share fraud intelligence to protect Canadians and assist victims. Through initiatives like these, we can take action before Canadians fall victim. Well done to all partners! The work is just starting.

Initiatives like Maple Disruption highlight the importance of cross sector collaboration in the fight against cybercrime, and the NetBeacon Institute was pleased to contribute its expertise and resources to this year’s sprint. Criminals are able to exploit platforms and services regardless of jurisdiction, so bringing like-minded organizations together to disrupt these activities is an important part of protecting Canadians online. We saw hundreds of malicious domain names taken offline as part of Maple Disruption and are hopeful that this action is only the beginning of ongoing collaborative efforts. Kudos to the RCMP National Cyber Crime Coordination Centre and the Canadian Anti-Fraud Centre for their work in making this happen.

In-person, interagency collaboration sparks a truly collaborative approach to disruption. I would have never known this actionable intelligence without sitting next to Maple Disruption partners.

Reporting

The RCMP, NC3 and CAFC strongly recommend that anyone who has experienced or witnessed a fraud or cybercrime contact their local police immediately. It is also important for you to report the incident online at Report Cybercrime and Fraud or by phone at 1-888-495-8501.

Want to help efforts like Maple Disruption? Public reporting is critical to an effective response from police and cybersecurity partners. The information gathered from reports helps us form a more complete picture of how cybercrime and fraud are affecting Canadians and strategically focus our resources on prevention, awareness, and disruption efforts.

Related links

- Maple Disruption 2025 – Over 3000 disruptive actions taken against fraudsters and cybercriminals

- RCMP’s National Cybercrime Coordination Centre and Canadian Anti-Fraud Centre launch Maple Disruption 2025 to combat cybercrime and fraud

- Report Cybercrime and Fraud

- Phishing

- Bank investigator fraud

- Cryptocurrency fraud

- Date modified: